Know Your Customer

What is KYC and why do you need to confirm my ID

Operators do not undertake these steps to mess us around, whilst some may see these measures as unnecessary, they are genuinely there to protect us and to comply with laws of the land. AML requirements aside, operators verify customers ID’s for 3 main reasons in the first place; a) to ensure a customer is who they say they are and b) are not underage and c) the player has not self-excluded.

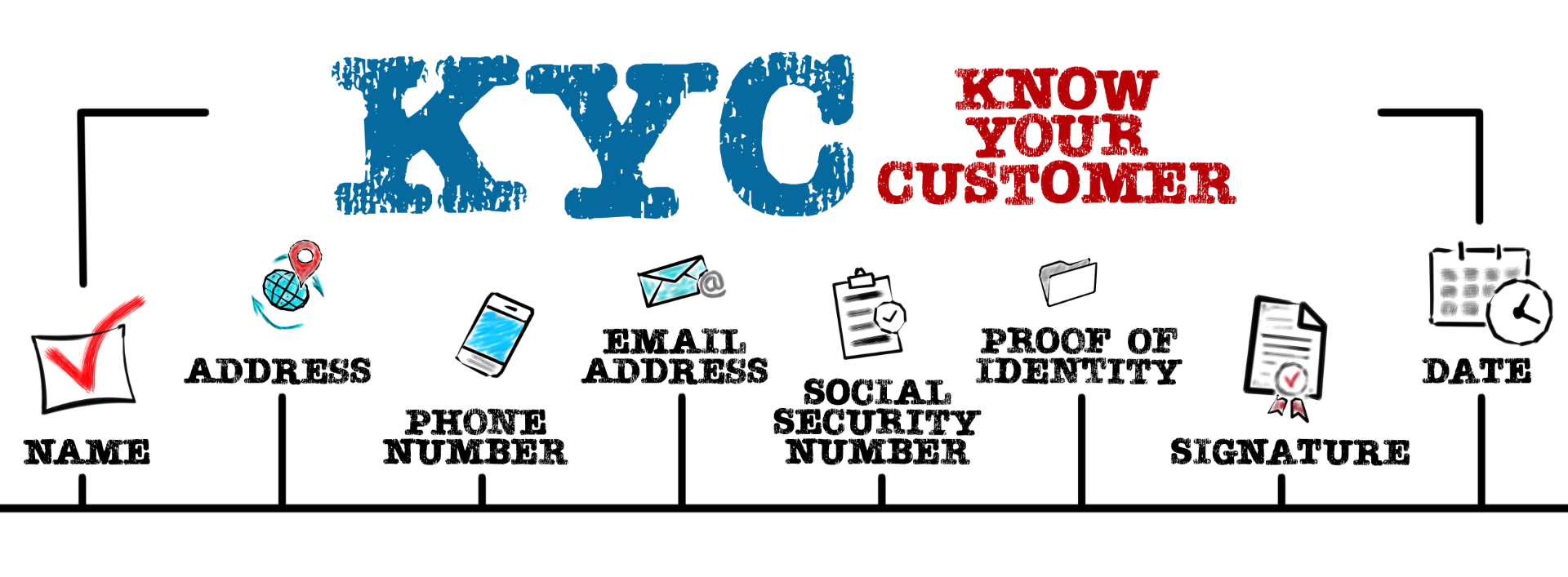

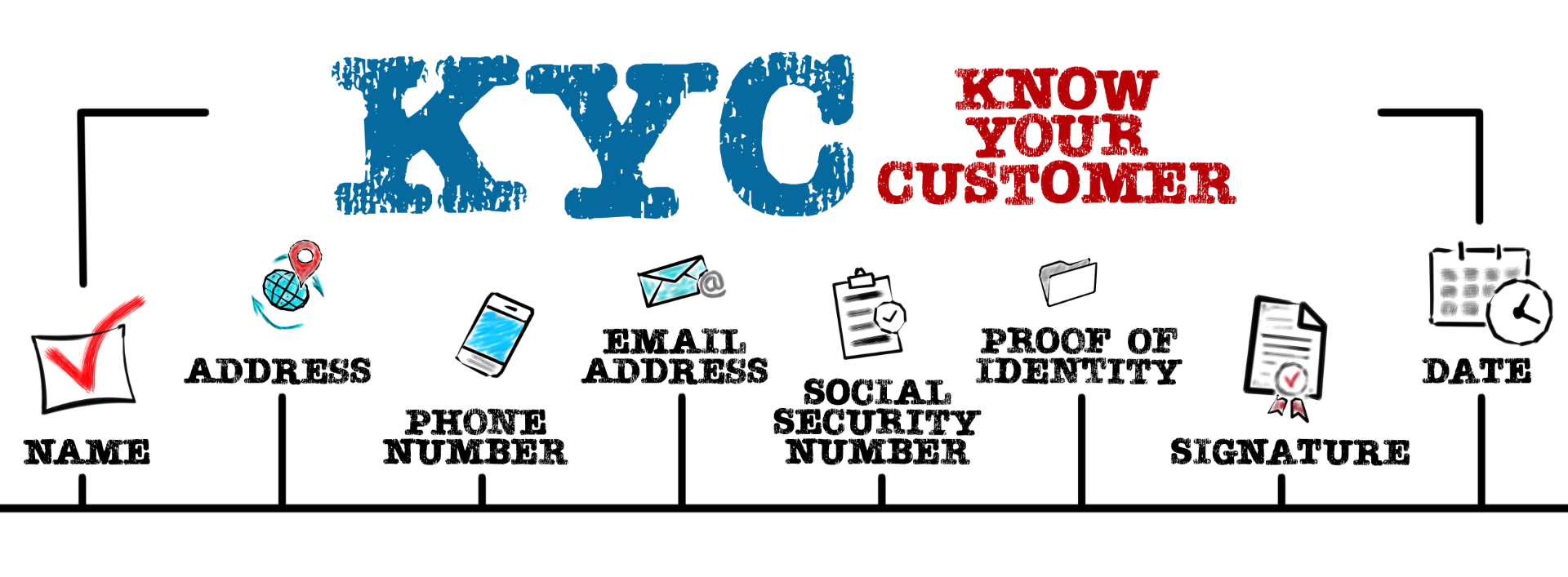

The Know Your Customer (KYC) process is a means of identifying and verifying the identity of the customer through independent and reliable source of documents, data or information and is a regulatory requirement which practically all businesses that deal with financial transactions are required to comply with. Online casinos and sportsbooks, by the inherent nature of their business operations, process innumerable financial transactions each day and are thus required to comply with KYC regulations.

One of the objectives of KYC is to reduce the risk of illicit activities such as identity theft, money laundering and other financial crimes by verifying the identity, address, age etc. of every customer. Online operations deal with huge volumes of money each day and given that the operators never actually see or interact with the players face to face, the risk of financial crimes being committed at online casino or sports platforms is high.

Here is a real-world analogy that can be used to understand KYC – let’s assume you want to apply for a credit card from a certain bank since it has great offers on online shopping which is something you often indulge in. During the application process, the bank will require you to produce certain documentary evidence as to who you are, where you get your money from and where you live. KYC done at online casinos (eKYC) is effectively the same thing except that it is done fully online without the need for your physical presence.

So, what do I need to do for KYC?

Completing your KYC verification at an online casino usually involves submitting the required documents and then waiting to hear back from the verification team. The verification process is generally carried out once.

Once your account is considered verified, all features are unlocked. Usually, verification is required before your first withdrawal request can be processed. However, a player can choose to complete the verification process right after registration. There is no need to wait until the first withdrawal. This, in fact, will avoid any delays in receiving your first cash out.

If you play frequently, make large deposits or win large amounts, then your actions may mean you pass certain predefined thresholds which will trigger the requirement for you to present additional information to prove your SOW ..or source of wealth / funds’, to prove that the money you are playing with is legitimately acquired. You could be asked to provide bank statements, tax certificates or proof of ownership.

Some operators may have an email address to which you can send an email with all the required documents attached. More commonly, casinos will offer a portal which is accessible after you login to your account. Here, you can upload and attach the required KYC documents and submit it for verification.

Certain documents are required in order to establish / prove the following – your identity, age, address, source of funds and proof of payment method. (Proof of payment method generally applies to credit or debit cards only. While uploading copies of the front and back of your credit / debit card, you should remember to block the middle digits of your card number and also your 3 – digit security code.)

• Documents accepted as ID proof: A government issued photo ID card such as a passport or a driver’s license will suffice

• Documents accepted as address proof: A municipal water and electricity account or utility bill within the last three months (should be in your name), or a bank statement with your address on it, tax certificate, recent active lease or rental agreement, etc.

• Source of funds: bank statements, salary payslips, dividends, trust deed, pension slips, director’s renumeration, sale of property, etc.

When Completing KYC, please keep the following in mind;

• It is mandatory for any reputable and regulated operator that offers real money casino games or sports bets to carry out KYC verification in order to operate lawfully. Failure to comply with KYC verification may not only have negative consequences for the casino in terms of losses faced due to money laundering and identity theft, but casinos can also be fined. Gambling regulatory authorities are cracking down hard on online casinos in recent years.

• One of the most common mistakes we see at online casinos with regards to KYC is made during the registration process. When registering as a member at an online casino, you will be required to complete a registration form that usually requests for personal details, contact details and account details. When it comes to details like name and address, it is vital to enter them correctly and ensure that what you are entering matches with your official documents. This way, when you later submit your documents for KYC verification, there is no mismatch which can result in the verification failing.

• The vast majority of online casinos will allow you to register for an account, deposit money and even play games for real money without having completed your KYC verification. However, when you wish to withdraw funds from your casino account, the casino will require you to complete KYC verification. A player can choose to complete KYC verification right after registering with a casino and we recommend doing this before you deposit money.